Stop Phishing in Its Tracks: How Verified Mark Certificates Secure Banking Emails

2 May, 2024

Phishing scams are a constant threat in today’s digital world, and the financial industry is a prime target. With billions of emails flying around daily, it’s easy for scammers to impersonate your bank and steal your sensitive information. But fear not, there’s a new weapon in the fight against phishing: Verified Blue Checkmark.

The Problem: A Sea of Emails, a Minefield of Scams

The sheer volume of emails makes it challenging to distinguish legitimate messages from phishing attempts. According to the Federal Trade Commission (FTC), a staggering 347 billion emails are sent daily, and banking scams alone cost people a whopping $10 billion in 2023. Traditional email security simply isn’t enough.

Enter the Blue Tick: Verified Senders with VMCs

Imagine receiving an email from your bank with a verified blue checkmark next to their name in your inbox. That’s the power of Verified Mark Certificates (VMCs). These certificates act like digital passports, verifying the sender’s identity and displaying their logo – a trusted visual cue – right alongside the email address.

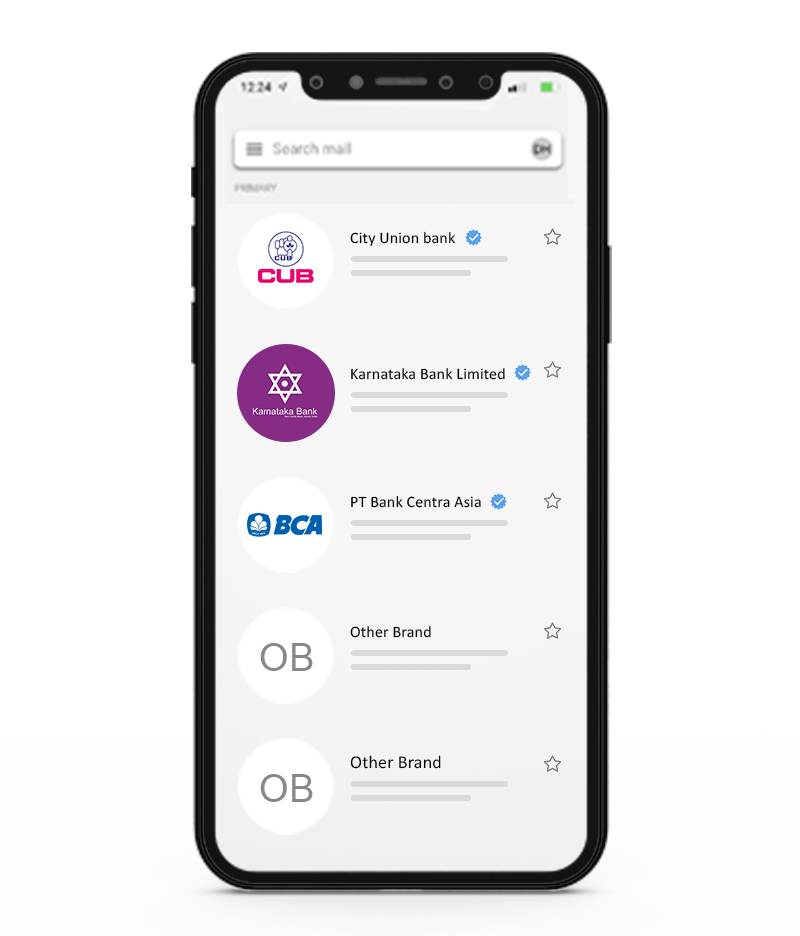

Real-World Examples: Banks Leading the Charge

Several leading banks are already leveraging Verified Mark Certificates (VMCs) to secure their email communication. Here are a few examples:

- CityUnionbank (India): Providing essential financial services like savings accounts, loans, and online banking.

- Karnataka Bank Limited (India): Offering a customer-centric approach with savings accounts, loans, and investments.

- PT Bank Centra Asia (Indonesia): A trusted Indonesian bank delivering comprehensive banking solutions.

Beyond Security: The Benefits of Verified Emails for Banks

Verified Mark Certificates (VMCs) go beyond just preventing phishing. Here’s how verified emails benefit both banks and their customers:

- Increased Trust and Brand Recognition: Customers see your verified logo before opening the email, fostering trust and brand recognition.

- Enhanced Customer Experience: Verified emails create a more secure and consistent experience for your customers.

- Improved Engagement Rates: Studies show VMCs can boost email engagement by up to 10%.

- Stronger Security Posture: VMCs work alongside DMARC compliance, a powerful tool against email spoofing.

How Verified Emails Work: The Winning Formula

Verified Mark Certificate (VMC), combined with DMARC enforcement and BIMI (Brand Indicators for Message Identification), create a powerful trifecta: Logo-verified with blue checkmark Email.

What are Verified Mark Certificate (VMC)?

Verified Mark Certificates are a new type of digital certificate that allows banks to display their logo next to the sender field in customer inboxes. DigiCert®, a leading SSL provider, issues VMCs after a rigorous validation process to ensure the logo adheres to trademark regulations.

10 Reasons Why Banks Need Verified Emails

With VMCs, banks can finally combat phishing scams and create a secure, trustworthy email communication channel with their customers. By implementing verified emails, banks can build stronger relationships, enhance brand reputation, and ultimately, empower their customers to manage their finances with confidence.

- Boost Customer Confidence: Verified logos with blue checkmarks build trust instantly.

- Consistent Brand Experience: Customers see your logo consistently, creating a sense of familiarity.

- Stand Out from the Crowd: Verified emails differentiate your bank from the competition.

- Increased Visibility and Engagement: Get noticed and improve email open rates.

- Demonstrate Security Commitment: Show your dedication to protecting your customers’ information.

- Stop Phishing Attacks: Verified emails make it harder for scammers to impersonate your bank.

- Greater Visibility into Email Traffic: Gain insights into email activity and potential security threats.

- Improved Email Deliverability: Ensure legitimate emails reach your customers’ inboxes.